OHA introduces new Mahi ʻAi Agricultural Loan

The Office of Hawaiian Affairs (OHA) Native Hawaiian Revolving Loan Fund program is introducing a new program this month to support Native Hawaiian farmers across the pae ʻāina. The Mahi ‘Ai Agricultural Loan Program is another way that OHA is meeting the business …

Flavors of Italy: Fresh Cheese and Italian Wine in the Heart of Honolulu

Desiree Kanae Loperfido and her husband, Chef Donato Loperfido, are building on their vision to bring Italy to Hawaiʻi. The couple operates Flavors of Italy LLC, a licensed importer and distributor of alcohol and spirits specializing in a wide range …

Flavors of Italy: Fresh Cheese and Italian Wine in the Heart of Honolulu Read more »

Soaring to New Heights with an OHA Mālama Education Loan

Kawehi Napoleon beams with pride when talking about her son, Wailani Wong, who dreamed of becoming a pilot for Hawaiian Airlines since he was 2 years old; and she has been cheering for him every step of the way. “He …

Soaring to New Heights with an OHA Mālama Education Loan Read more »

No Fear of Failure

“You have to strive to fail,” said Malia Tallett (P.T., D.P.T., T.P.S.), owner of Ke Ola Kino Physical Therapy in Hilo. “You don’t learn from being successful. I have failed a number of times, but failure doesn’t mean you’re done. …

Office of Hawaiian Affairs Native Hawaiian Revolving Loan Fund Program Outcome Evaluation 2020

This report describes the results of the Office of Hawaiian Affairs’ (OHA) 2020 outcome evaluation of the Native Hawaiian Revolving Loan Fund program (NHRLF). OHA’s loan program annually surveys its borrowers to evaluate the impact of consumer and business loans …

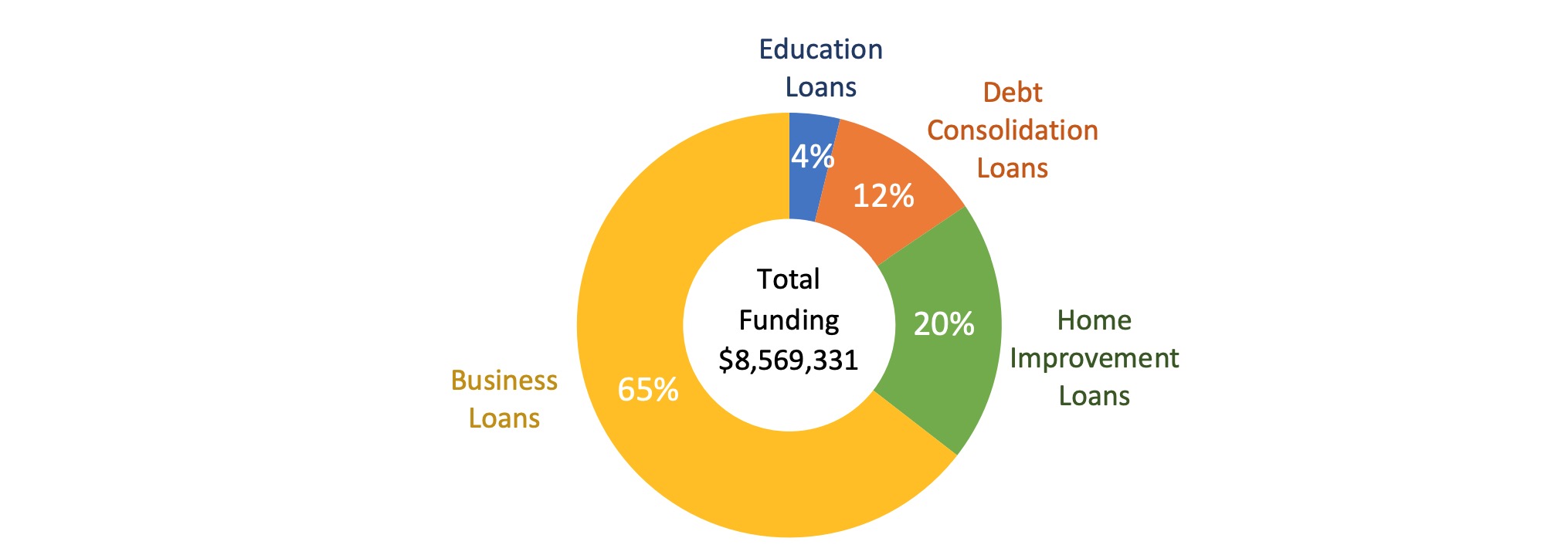

OHA Mālama Loans Helps Generations of Hawaiians Fulfill Their Dreams

OHA Mālama Loans has been supplying Native Hawaiians with the resources to achieve their goals for over 30 years. The program provides loans to help our lahui consolidate debt, achieve higher education, begin their small businesses and make improvements to …

OHA Mālama Loans Helps Generations of Hawaiians Fulfill Their Dreams Read more »

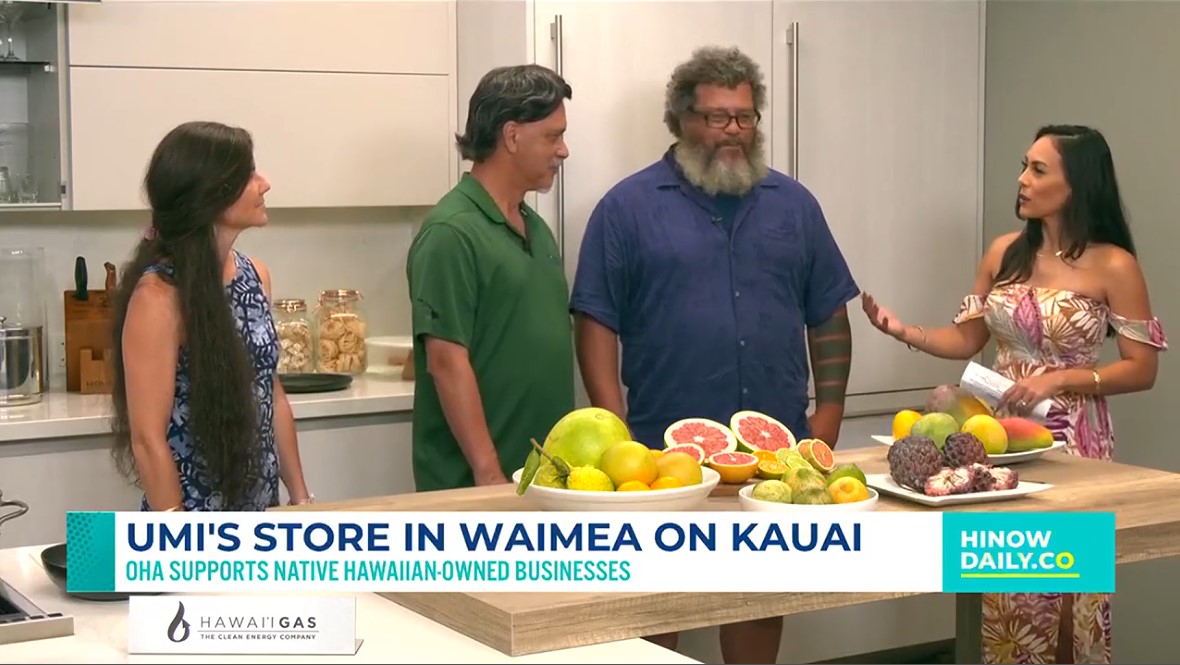

Kalei’s Lunchbox – Serving Aloha and Hope

You can smell the ono grinds coming from Kalei’s Lunchbox, a lunch wagon located in Kahului, Maui. In May 2021, a second location of Kalei’s Lunchbox opened up at the Pukalani Terrace Shopping Center. Kalei’s not only serves up delicious …